Are You Planning for a Long Life or a Good Life?

Retirement isn’t just about stopping work—it’s about sustaining a lifestyle that supports both financial security and well-being. With medical advancements extending lifespans, the challenge isn’t just living longer but living well. If we want to thrive in our later years, we need to rethink retirement planning through the lens of longevity, healthspan, and financial sustainability.

The Longevity Revolution

Why Retirement Needs a New Approach

We are in the midst of a longevity revolution. Advances in medicine and technology mean many of us will live well into our 80s, 90s, and beyond. However, as BlackRock CEO Larry Fink points out, while society invests heavily in extending lifespans, we often overlook the financial strategies required to support these additional years.

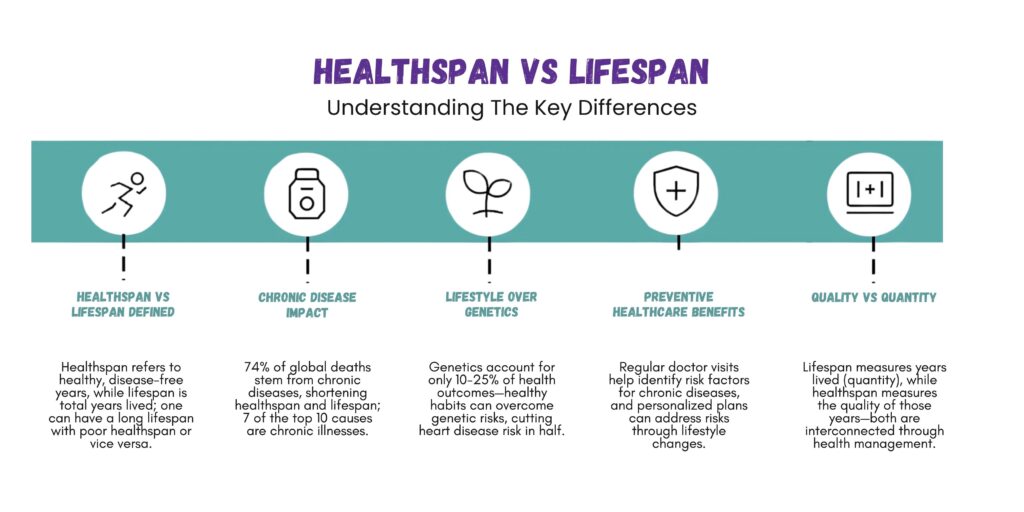

Without proper planning, increased longevity can lead to financial strain, health challenges, and a diminished quality of life. The key is to align healthspan (years of good health) with lifespan so that those extra years are active, fulfilling, and financially stable.

Healthspan vs. Lifespan

Why Health is Wealth

A longer life is only valuable if it is lived in good health. Studies show that wealthier individuals experience more disability-free years, highlighting the link between financial security and well-being. To maximize healthspan, retirees must prioritize wellness just as much as wealth.

Key Strategies for Extending Healthspan:

- Stay active: Regular movement preserves mobility and cognitive function.

- Invest in preventive care: Early detection of health issues saves money and extends quality of life.

- Adopt a longevity mindset: Shift away from aging stereotypes and take proactive steps to stay healthy.

For additional resources on how to stay active and healthy as you age, check out Ageless Workout, a leading platform focused on holistic aging and fitness.

The Financial Fountain

Creating Sustainable Retirement Income

Traditional retirement planning operates like a reservoir model, where savings gradually deplete over time. Instead, consider a fountain model, where income streams continuously flow through diversified financial tools like annuities, dividend investments, and passive income sources. This reduces the fear of outliving savings and supports long-term financial wellness.

Actionable Tips for Financial Longevity:

- Diversify income sources: Incorporate annuities, real estate, and other revenue-generating assets.

- Leverage Health Savings Accounts (HSAs): Cover medical expenses tax-efficiently.

- Plan for long-term care: Integrate health history into financial strategies.

Addressing Retirement Inequities

Bridging the Gap

Not everyone enters retirement on equal footing. Studies reveal significant disparities in retirement outcomes, with wealthier individuals enjoying longer and healthier post-work years. To close this gap, policymakers and financial institutions must promote accessible financial planning, such as:

- Auto-enrollment in 401(k) plans

- Financial literacy programs for underrepresented communities

- More inclusive long-term care solutions

Discover AARP’s 10 essential steps to prepare for a fulfilling retirement.

The Path Forward

A Holistic Retirement Strategy

The future of retirement isn’t just about money—it’s about aligning health and wealth to create a fulfilling, purpose-driven life. Financial advisors, healthcare professionals, and individuals must collaborate to develop a holistic plan that integrates physical well-being with financial security.

Thrive, Don’t Just Survive

Retirement isn’t just about making it through another decade—it’s about making those years truly count. By adopting a forward-thinking approach to longevity, health, and financial stability, retirees can enjoy a life that is not just longer, but richer in every sense of the word.

Take Action Today

Are you ready to rethink your retirement? Start by evaluating your financial longevity plan and healthspan strategy. Consult with a financial planner and healthcare expert to ensure you’re set up for a vibrant future.

🎥 Watch this video for more insights: Redefining Retirement: Thriving in the Era of Longevity